Facebook sees first-ever drop in daily active users as owner Meta takes $200bn share hit

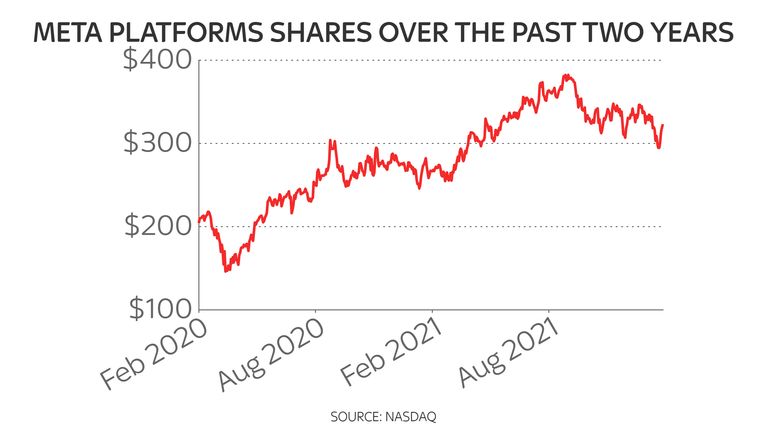

Shares decline by as much as 23% in extended trading that sees rivals such as Twitter also come under pressure from investors as they fret over advertising demand in the tougher economy.

Thursday 3 February 2022 10:02, UK

Facebook's parent company, Meta, has seen over a fifth of its market value erased in after-hours trading after financial results disappointed on several key measures and it warned current quarter revenues would fall short.

The US tech giant also said Facebook has seen a drop in its daily active users for the first time in its 18-year history.

The number fell from 1.929bn in the three months to the end of December, compared with 1.930bn in the previous quarter, Meta said.

Meta, which also includes Instagram in its stable of social media platforms, said it had been informed by advertisers that surging inflation and supply chain disruption were damaging their budgets.

It also faces increasing competition for users from rivals such as TikTok.

The company also pointed to the impact of the continuing row between platforms and Apple over device privacy settings which have made it harder for advertisers to understand their market - changes it warned could result in a $10bn hit for 2022.

Advertising accounts for the majority of revenue at Meta.

It declared on Wednesday that sales in the current first quarter of 2022 would not meet market forecasts because of the twin ad pressures, pencilling in a figure of $27bn-$29bn compared with a figure of $30bn expected by Wall Street.

Its shares were down by more than 20% in response. It equates to a hit of $200bn in market value.

Other big names, such as Twitter and Snap, also recorded big declines as investors fretted over wider advertising demand.

Spotify, too, was in focus as it forecast current quarter subscribers lower than analysts' estimates - sending shares as much as 18% lower. It had already been dealing with controversy around The Joe Rogan Experience podcast.

It took the gloss off an earnings season for tech stocks that had been largely positive so far - helping shore up values after a shaky start to 2022.

Google's parent firm had wowed investors just 24 hours earlier. Alphabet shares were among the fallers in the late dealing.

The irony was that Meta's fourth quarter revenue figure of $33.7bn, up from $28bn a year earlier, was the only metric that exceeded analysts' estimates in its latest results.

But quarterly profits fell by 8% to $10.3bn.

For the year as a whole, revenues climbed 37% to $117.9bn and profits rose 35% to $39.4bn.

Meta broke out the performance at its Reality Labs division for the first time - part of the business that is not expected to be profitable for some years.

The augmented and virtual reality division reported a net loss of $10.2bn for 2021 as a whole. That was up from $6.6bn over the previous year.

Mark Zuckerberg, Meta founder and chief executive, told investors: "We had a solid (fourth) quarter as people turned to our products to stay connected and businesses continued to use our services to grow.

"I'm encouraged by the progress we made this past year in a number of important growth areas like Reels, commerce, and virtual reality, and we'll continue investing in these and other key priorities in 2022 as we work towards building the metaverse."

The company also confirmed its stock exchange ticker would complete the Meta rebrand and become "META" later this year.

Laura Hoy, equity analyst at Hargreaves Lansdown, said of the market's reaction: "Meta CEO Mark Zuckerberg may be keen to coax the world into an alternate reality, but disappointing fourth quarter results were quick to burst his metaverse bubble.

"While revenue beat expectations, a marked rise in spending meant profits declined by 1% in the fourth quarter.

"Investors were understandably troubled by the results, made worse by news that the current quarter was coming with a host of headwinds - not least of which being uncertainty about advertising budgets.

"Facebook depends on advertising revenue to support growth.

"The group constantly needs to upgrade and expand its servers and networks. Research and development is another drain on incoming cash as the group looks for new ways to keep its users entertained and work around clever ad blockers.

"With total spend expected to rise at least 26% in the year ahead, profit declines simply won't cut it."