The Fairholme Focused Income Fund (Trades, Portfolio) released this week its fourth-quarter portfolio update in a 13-F filing, reporting that its top trades included the closure of its Western Midstream Partners LP (WES, Financial) position and new holdings in five companies: Apple Inc. (AAPL, Financial), LyondellBasell Industries NV (LYB, Financial), Dow Inc. (DOW, Financial), Walgreens Boots Alliance Inc. (WBA, Financial) and Newcrest Mining Ltd. (ASX:NCM, Financial).

Managed by Fairholme Capital Management leader Bruce Berkowitz (Trades, Portfolio), the fund seeks long-term capital appreciation by investing in a focused portfolio of cash-distributing securities, which include corporate debt, government and agency debt, bank loans, convertible bonds, preferred and common stock. The fund applies the Miami-based firm’s focused, multi-sector, multi-strategy, value-based approach.

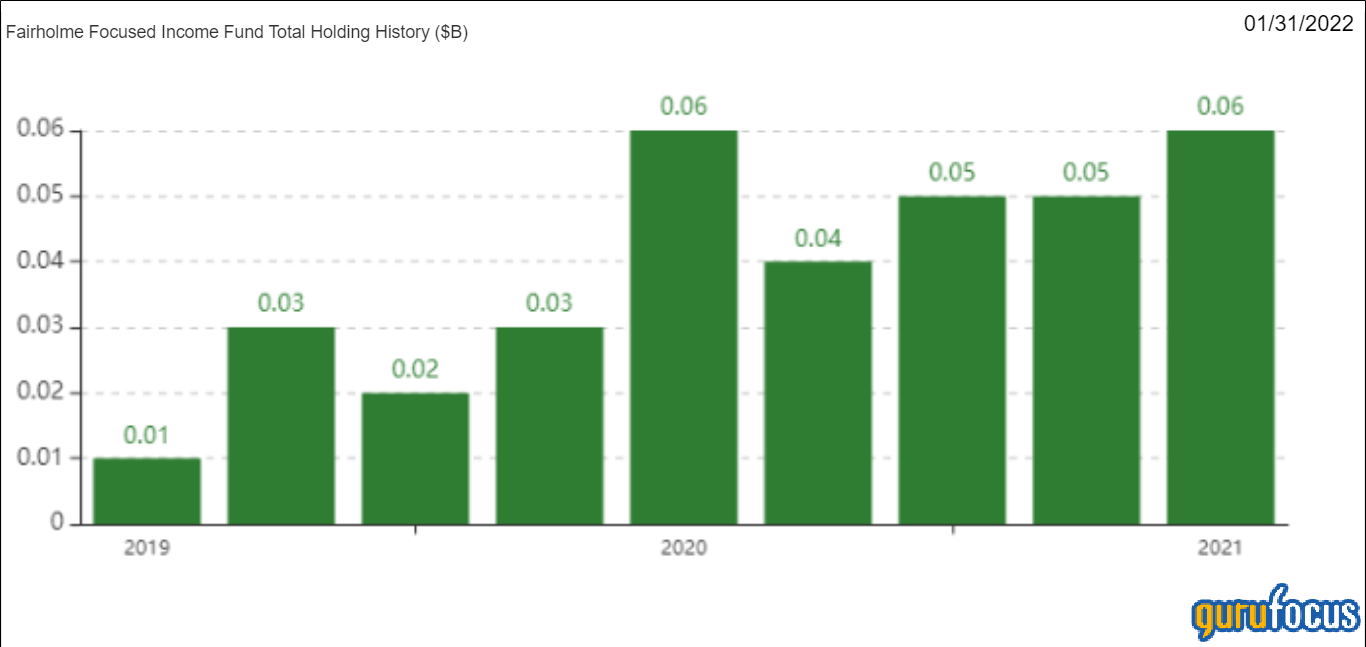

As of November 2021, the fund’s $63 million equity portfolio contains 16 stocks with a turnover ratio of 31%. The top three sectors in terms of weight are energy, basic materials and financial services, representing 46.74%, 23.97% and 16.99% of the equity portfolio.

Western Midstream Partners

The fund sold all 193,400 shares of Western Midstream Partners (WES, Financial), trimming 7.96% of its equity portfolio.

Shares of Western Midstream Partners averaged $21.30 during the fourth quarter; the stock is overvalued based on Monday’s price-to-GF Value ratio of 1.29.

GuruFocus ranks the Woodlands, Texas-based energy company’s profitability 7 out of 10 on the back of profit margins and returns outperforming more than 82% of global competitors despite three-year revenue and earnings decline rates underperforming over 60% of global energy companies.

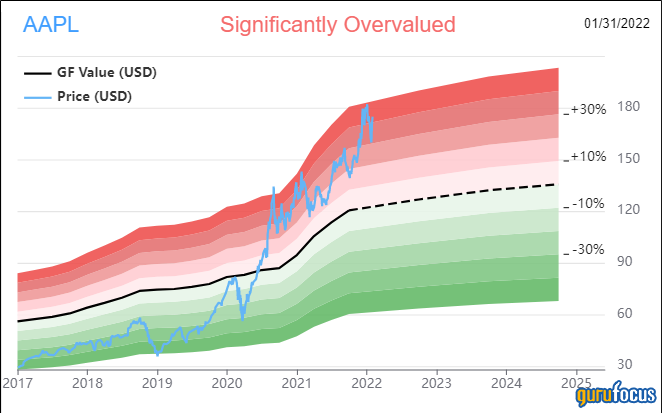

Apple

The fund purchased 9,800 shares of Apple (AAPL, Financial), giving the position 2.59% equity portfolio weight. Shares averaged $149.68 during the fourth quarter; the stock is significantly overvalued based on Monday’s price-to-GF Value ratio of 1.43.

GuruFocus ranks the Cupertino, California-based consumer electronics giant’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 7 and profit margins and returns that outperform more than 96% of global competitors.

Other gurus with holdings in Apple include Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) and Ken Fisher (Trades, Portfolio)’s Fisher Investments.

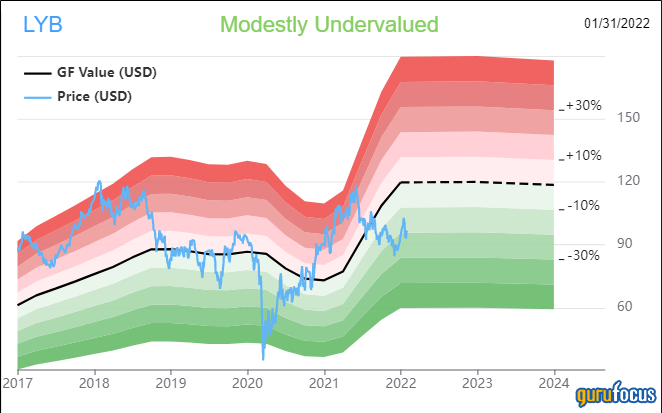

LyondellBasell Industries

The fund purchased 40,500 shares of LyondellBasell Industries (LYB, Financial), giving the position 5.64% weight in the equity portfolio. Shares averaged $94.46 during the fourth quarter; the stock is modestly undervalued based on Monday’s price-to-GF Value ratio of 0.81.

GuruFocus ranks the U.K.-based chemical company’s profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that are outperforming more than 76% of global competitors.

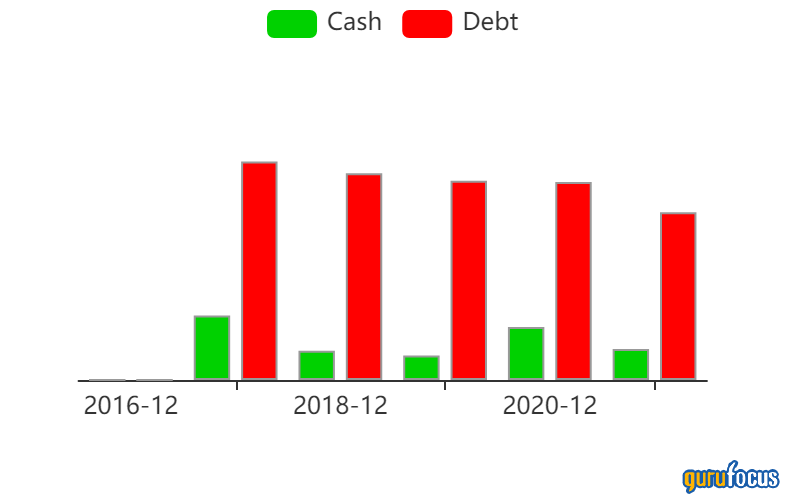

Dow

The fund purchased 21,700 shares of Dow (DOW, Financial), giving the position 1.91% of equity portfolio space. Shares averaged $58.74 during the fourth quarter; the stock is fairly valued based on Monday’s price-to-GF Value ratio of 0.94.

GuruFocus ranks the Midland, Michigan-based chemical company’s financial strength 4 out of 10 on the back of cash-to-debt and debt-to-equity ratios underperforming more than 81% of global competitors despite the company having a high Piotroski F-score of 8.

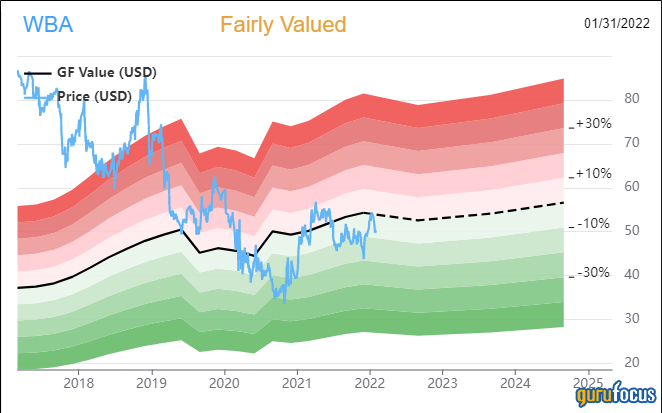

Walgreens

The fund purchased 24,000 shares of Walgreens (WBA, Financial), giving the position 1.72% of equity portfolio space.

Shares of Walgreens averaged $48.50 during the fourth quarter; the stock is fairly valued based on Monday’s price-to-GF Value ratio of 0.92.

GuruFocus ranks the Deerfield, Illinois-based retail pharmacy chain’s financial strength 4 out of 10 on the back of interest coverage and debt ratios underperforming more than 69% of global competitors.

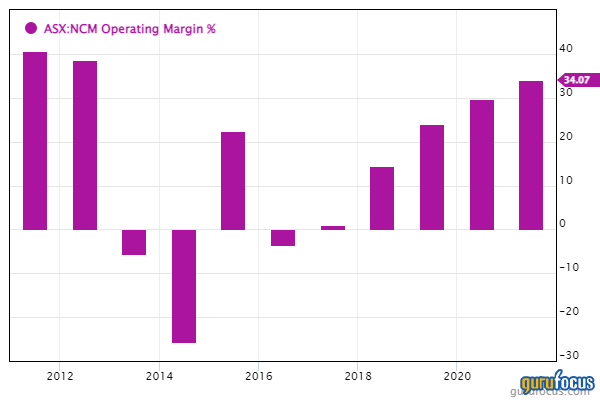

Newcrest Mining

The fund purchased 58,000 shares of Newcrest Mining (ASX:NCM, Financial), giving the position 1.56% equity portfolio weight. Shares averaged 24.28 Australian dollars ($17.16) during the fourth quarter; the stock is modestly undervalued based on Monday’s price-to-GF Value ratio of 0.74.

GuruFocus ranks the Australian metals and mining company’s profitability 6 out of 10 on the back of profit margins and returns outperforming more than 88% of global competitors despite three-year revenue and earnings growth rates topping just over 66% of global metals and mining companies.

Also check out:- Fairholme Focused Income Fund Undervalued Stocks

- Fairholme Focused Income Fund Top Growth Companies

- Fairholme Focused Income Fund High Yield stocks, and

- Stocks that Fairholme Focused Income Fund keeps buying

- Bruce Berkowitz Undervalued Stocks

- Bruce Berkowitz Top Growth Companies

- Bruce Berkowitz High Yield stocks, and

- Stocks that Bruce Berkowitz keeps buying