CSX hopes to have people in place to handle anticipated volume growth in 2022, particularly in the second half of the year, according to executives speaking on CSX’s fourth-quarter 2021 earnings call late Thursday.

The eastern U.S. railroad said the lack of available employees due to COVID-19-induced absences stymied CSX’s ability to fully market demand in the fourth quarter.

“CSX is no different than any other industry right now, where we have been challenged finding people to come to work. And because we have been short on our train and engine service employees, the simple fact is we have not been able to move the amount of freight we could have, had we been staffed up at the appropriate levels,” said CSX President and CEO Jim Foote.

Average daily cases of CSX (NASDAQ: CSX) employees with COVID-19 have increased by “several hundred” employees since early November, with cases approaching prior peak levels.

“This is probably one of the most difficult environments we’ve ever seen. When you think about all the stuff the rail industry has gone through over the past 10, 20 years, my 25 years of railroading, I can tell you, when you come in one week and you’ve got 60 people off on COVID, a new variant comes through and you’ve got 350 off on COVID on your T&E [train and engine] side, you really start to feel the effects,” said Jamie Boychuk, CSX executive vice president for operations.

To address staffing shortages, CSX for months has been aggressively seeking to fill its ranks of train and engine employees in order to move trains. The railroad has been consistently filling weekly training classes and has a “strong pipeline of candidates,” according to Boychuk.

As a result of these efforts, the number of employees qualifying and moving to active status has increased almost 50% sequentially in the fourth quarter to approximately 150 employees, Boychuk said. CSX also anticipates that this number will double to over 300 employees in the first quarter of 2022.

“There is no doubt that the hiring actions taken to date have allowed us to better manage the current situation. We have also supplemented this hiring by bringing additional assets online to help offset network imbalance caused by pockets of concentrated case counts,” Boychuk said. “We will maintain these tactical asset increases as needed to protect service. We will look to improve asset utilization and drive increased operating efficiency as employees return to work and our ongoing hire initiatives provide the necessary resources to move incremental volumes and deliver the expected high-quality service for our customers.”

In addition to addressing staffing shortages, CSX executives said the railroad is seeking to improve network fluidity to address supply chain congestion. CSX is investing in keeping intermodal terminals fluid by providing overflow space and supplemental labor to move long-dwelling boxes out of the terminals, according to Kevin Boone, executive vice president for sales and marketing.

CSX has also identified several strategic exciting extension opportunities that will provide additional long-term capacity by helping to alleviate congestion, while also supporting growth for years to come, Boone said.

CSX’s capital investment budget for 2022 is $2 billion, up $200 million from 2021.

As the company looks to 2022, CSX expects volumes to build sequentially throughout the year amid easing supply chain bottlenecks. As a result, volume growth is expected to be greater in the second half of the year, according to Foote.

Among the tailwinds for 2022 are an anticipated ramp-up in automotive production and continued briskness for international intermodal, according to Boone. Domestic intermodal still needs to work through driver and equipment shortages, but “we do see the underlying demand there and I think that’s a good, positive story for us into the back half of the year,” Boone said.

Fourth-quarter 2021 financial results

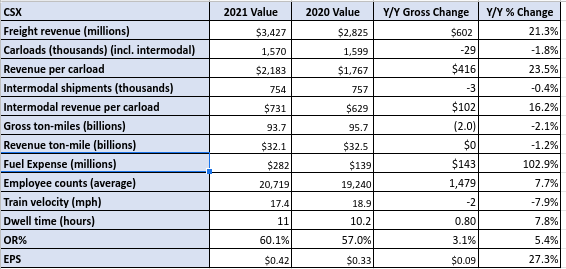

CSX’s net profit rose 23% in the fourth quarter of 2021 as a 21% increase in revenue helped to offset a 28% increase in expenses.

Fourth-quarter 2021 net income was $934 million, or 42 cents per diluted share, compared with $760 million, or 33 cents per diluted share, in the fourth quarter of 2020. CSX said prior-year results include a pretax charge of $48 million related to the early retirement of debt.

Revenue rose 21% in the fourth quarter to $3.43 billion, “driven by growth across all major lines of business, increases in other revenue and the inclusion of Quality Carriers’ results,” which CSX agreed to acquire in March 2021.

Expenses climbed 28% in the fourth quarter to over $2 billion amid higher fuel costs.

Fourth-quarter operating income rose 12% to $1.37 billion.

“As we enter 2022, we remain committed to providing our customers high-quality service and creating additional capacity to help them address current supply chain challenges through the increased use of rail,” Foote said in a Thursday release announcing the fourth-quarter results.

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.