Dividend investors could be interested in the following stocks, since they offer much higher dividend yields than the S&P 500 Index. The dividend of the benchmark index yields 1.25% as of the close of trading on Thursday. Wall Street sell-side analysts have also issued positive recommendation ratings for these stocks.

AbbVie Inc.

The first company dividend investors could be interested in is AbbVie Inc. (ABBV, Financial), a Chicago, Illinois-based drug major focusing on treatments for rheumatoid arthritis and psoriasis, as well as the development of therapies for specific forms of cancer.

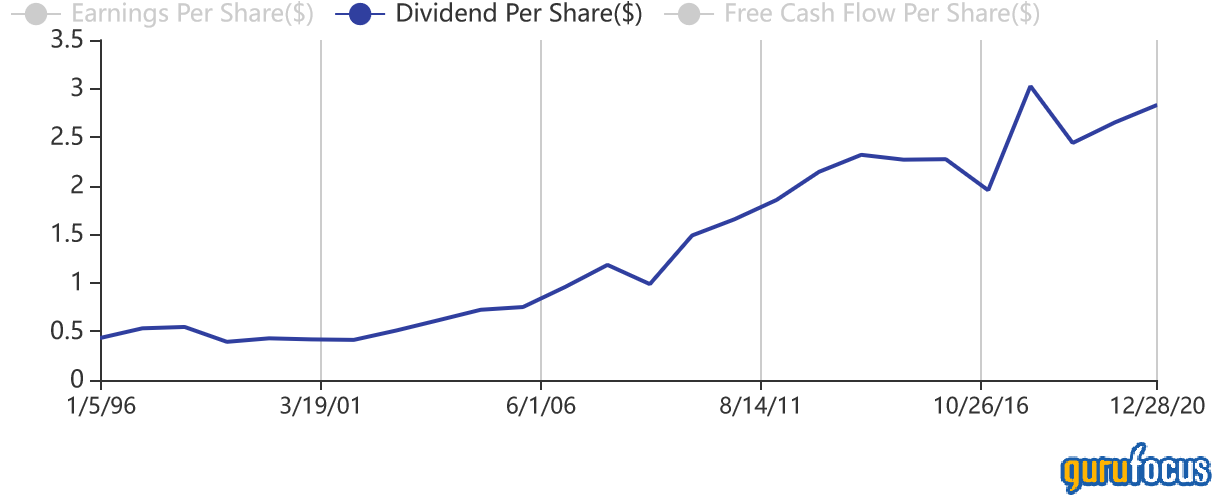

Based on Thursday's closing price of $133.09 per share, AbbVie Inc. offers a trailing 12-month dividend yield of 3.99% and a forward dividend yield of 4.24%. The company last paid a quarterly dividend of $1.30 per common share on Nov. 15. The next quarterly dividend will be $1.41 per share and will be paid on Feb. 15, 2022. The company has paid dividends for about eight years.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $132.95 per share.

The share price has risen by 28.65% over the past year, determining a market capitalization of $235.29 billion and a 52-week range of $101.81 to $133.77.

The 14-day relative strength index of 76 indicates the stock is neither overbought nor oversold.

Bristol-Myers Squibb Co.

The second company dividend investors could be interested in is Bristol-Myers Squibb Co. (BMY, Financial), a New York-based drug major.

Based on Thursday's closing price of $62.05 per share, Bristol-Myers Squibb Co. grants offers a trailing 12-month dividend yield of 3.16% and a forward dividend yield of 3.48%. The company last paid a quarterly dividend of $0.49 per common share on Nov. 1. The next quarterly dividend will be $0.54 per share and will be paid on Feb. 1, 2022. The company has paid dividends for 31 years.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $72.28 per share.

The share price has increased by 1.52% over the past year for a market capitalization of $137.73 billion and a 52-week range of $53.22 to $69.75.

The 14-day relative strength index of 66 suggests the stock is neither overbought nor oversold.

British American Tobacco PLC

The third company dividend investors could be interested in is British American Tobacco PLC (BTI, Financial), a London, U.K.-based tobacco giant.

Based on Thursday's closing price of $37.07 per share, British American Tobacco PLC offers trailing 12-month and forward dividend yields of 8.05%. The last quarterly payment of $0.746 per common share was made on Nov. 16. The next quarterly dividend will be of same amount per share and will be paid on Feb. 14, 2022. The company has paid dividends for about 12 years.

On Wall Street, the stock has one recommendation rating of buy with a target price of $51.12 per share.

The share price has fallen by 1.13% over the past year, determining a market capitalization of $85.06 billion and a 52-week range of $33.62 to $41.14.

The 14-day relative strength index of 63 indicates the stock is neither overbought nor oversold.